Total Investment Cost: NFB Asset Management Funds vs Competitors

How NFB Asset Management’s Total investment Cost stacks up

Total Investment Cost (TIC) is a very useful tool that enables investors to have an accurate understanding of the actual costs incurred when investing in collective investment schemes (CIS’s, unit trusts). Efficient cost management is vital when working with investments. High fees can have a large negative impact on investors’ returns. TIC is composed of the Total Expense Ratio (TER) and Transaction Costs (TC). TER indicates all fees and charges involved in managing a fund and is required to be displayed on minimum disclosure documents (MDD’s). TC is the cost of paying for all the underlying assets in a CIS, as well as all costs in administering the fund such as VAT, Bond spread costs, etc. TIC’s, TER’s and TC’s are expressed as a percentage of the CIS’s assets under management.

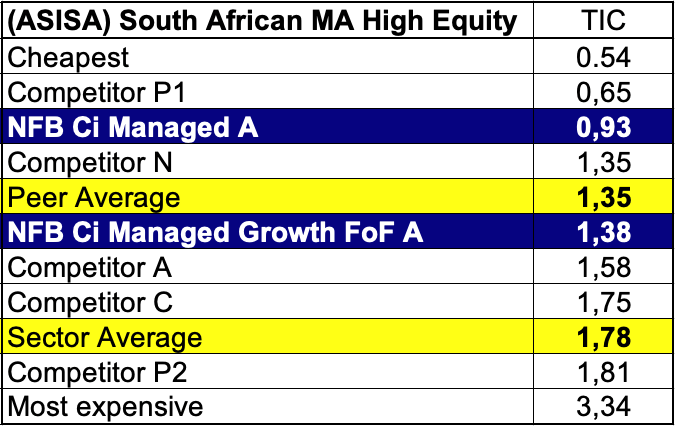

The average TIC within the ASISA: SA – MA - High Equity sector is 1.78%. Relative to this fee, the NFB Ci Managed Fund is cheaper by 0.85% whilst the NFB Ci Managed Growth Fund of Funds’ is cheaper by 0.40%.

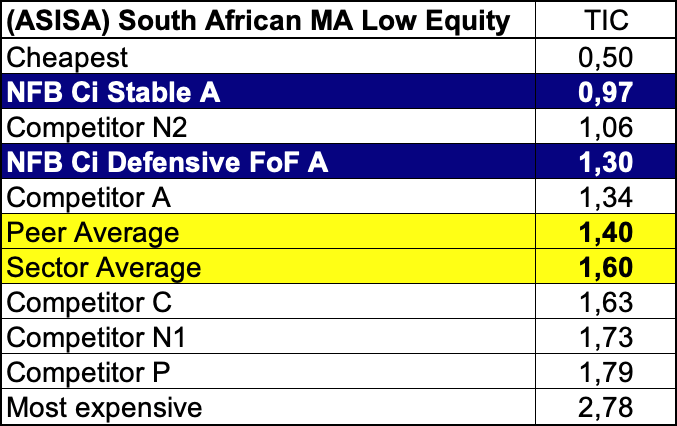

The average TIC within the ASISA: SA – MA - Low Equity sector is 1.60%. Relative to this fee, the NFB Ci Stable Fund is cheaper by 0.63% whilst the NFB Ci Defensive Fund of Funds is cheaper by 0.30%.