SA Government Bonds: Just how Attractive Are They?

In the current environment, South African nominal government bonds appear to be an attractive investment. But are they really as attractive as they appear?

There is no question that taken purely from an income point of view, bonds appear to be an attractive investment given that the yield curve is steep with cash rates significantly lower than long bond rates.

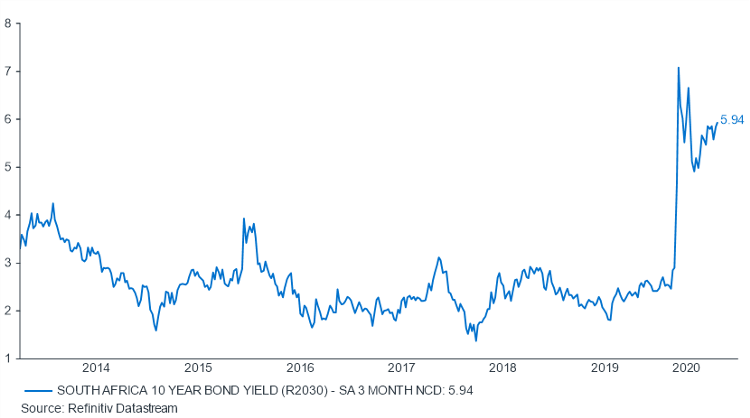

The yield on a 10-year bond is approximately 9.5% and the same value for 3 month debt is 3.53%, resulting in a difference, or spread, of 5.72%. A year ago this spread was 2.37%. In other words, investors can now earn more than twice the spread for the same increase in time to maturity, making for a significantly more attractive investment case.

The change in spread can be attributed to both 3-month rates going down after the South African Reserve Bank (SARB) cut interest rates dramatically to support Covid-19 relief efforts and an increase

in 10-year rates as the government’s fiscal position has become increasingly precarious

Bonds also offer an attractive return relative to inflation: 9.5% on a 10-year bond versus inflation which is currently under 3%.

However, while the investment case for bonds appears to be strong given that the yield curve is as steep as it has ever been, in reality this is not a risk free investment. The biggest concern around South African government bonds is the duration of the investment.

The key point to bear in mind is that the spread is only earned if the investment is held to maturity. In the case of a 10-year bond, this is 10 years away. A holding period any shorter than that exposes the investor to capital risk.

The modified duration for a 10-year South African government bond is currently 6.5. A 1% increase in interest rates results in a 6.5% fall in capital values. Between the end of May 2020 and the first week of July 2020 – a six week period subsequent to the lockdown induced sell-off where yields rose 5% - theyield on the 10-year bond rose from 8.8% to 9.5%, wiping out half of investor’s interest income for the year. On a 10-year bond, an increase in interest rates of 2% during the life of the bond eliminates 1.5 years of yield.

Even though interest rates are likely to go lower making long-bond yields even more attractive, they are not likely to go significantly lower and are unlikely to stay at these levels throughout the life of the bond. In other words, their attractiveness to cash will degrade over time. The same can be said for their attractiveness relative to inflation which is also currently at the bottom of the cycle. Those investors who don’t have a 10-year investment horizon are under appreciating this risk.

Investors will also need to reconcile the investment case for bonds with what is often a very bearish view on South Africa. This emotional gap will need filling throughout the life of the bond, as evidenced by the recent capital losses experienced in the bond market. Given South Africa’s implementation track record, a lot can go wrong within a 10-year investment horizon.

Also worth noting is that prescribed assets are likely going to be in some form of ownership of government bonds, most likely infrastructure bonds but this is very likely to include existing ownership of regular nominal and/or inflation-linked bonds. A bond purchase now may allow investors to get ahead of prescribed assets legislation at a yield of their choosing. If prescribed assets are enacted, investors choice of when to invest and thereby the luxury of assessing whether yields are sufficiently compensatory, goes away.

Also, keep in mind that prescribed assets effectively introduces an artificial buyer into the market which must distort the yield; most likely by capping how far it can rise. This is both a good thing in that bond investors to which prescribed assets do not apply have someone to offload to but that is far outweighed by artificial demand dragging yields down and thereby putting a cap on how well investors can be rewarded for the risk they’re taking.