35 Years in the Making

NFB has turned Knowledge Into Wealth for more than three decades. You’ve been our best investment.

NFB celebrates its 35th anniversary on the 1st April 2020. This is a special moment and a tribute to the leaders, staff, clients and institutions we are fortunate to serve. The story began in 1985 with a staff complement of seven people spread between Port Elizabeth and Cape Town. From this humble beginning, we have managed to grow the business to a point where today, we manage many billions both locally and abroad for hundreds of principally South African families.

Today, NFB forms an integral part of the NVest Group, which is listed on the Alt-X exchange of the JSE. The NVest Group consists of several businesses, including NFB Asset Management, a remarkably successful and award-winning business and NVest Securities, a fully licensed stockbroking member of the JSE.

NFB developed its early roots in Port Elizabeth and Cape Town, before spreading our wings to East London where NVest now has its Head Office.

Independence and service have been cornerstones of the business and the success we have had in retention of both key staff and clients bears testimony to this. In my opinion, one of the most rewarding facts in the business is the retention of key people, ranging from advisors, directors, and our very experienced administrative teams, to the operations team and many more.

It amazes me how often we are treated, as the leadership of NFB, to compliments addressed to many members of our broader team. From assistants, to receptionists, drivers and the ever-important tea ladies, we continue to receive accolades. Many of our clients and institutions have developed friendships with our staff. I trust that this will be a lasting characteristic of NFB.

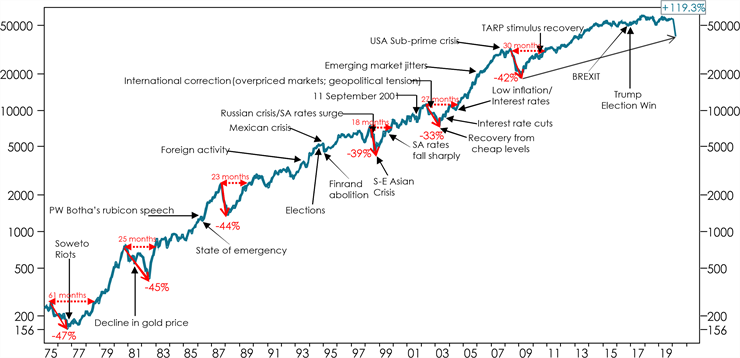

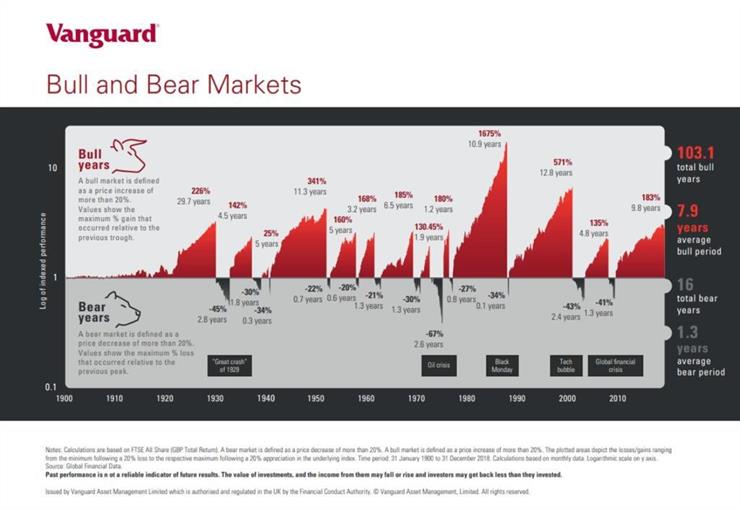

Changing tack to the very difficult times we are in, I would like to suggest the following: Right now, your personal health and well-being is most critical. We face a global reset in markets, having endured one of the most rapid, downward corrections in almost all asset classes of the modern era. Our shared responsibility is to confirm you have correctly allocated your savings and are available albeit we are all working remote of the office, to check details, values and carefully considering making changes. The combination of markets being so turbulent and the coincidence of the lock-down will result in heightened nervousness. On the premise that you have diverse investments, and these are invested in relevant assets and funds, we would suggest you remain invested. This doesn’t mean we believe the turbulence is over but looking at history, in every instance, what follows very negative markets, are very strong upward corrections, making selling when markets have fallen very concerning, as the ‘fix’ passes you by.

We would strongly advise you to engage with us to discuss your needs and portfolio dynamics in an effort to ensure you enjoy the correct long-term outcomes.

They say that “every cloud has a silver lining”. In times like these, this is not often considered. However, as a result of the recently announced Moody’s decision, South African bonds are showing very attractive rates. These offer tax efficient returns, either as a guaranteed outcome, or as monthly income. I would encourage those in need of income or guaranteed growth to chat to our advisory team.

This form of investment has become very relevant as interest rates have been cut and are likely to drop further in an effort by the Reserve Bank to stimulate the economy which has been weathering the perfect storm.

From the graph above you can see the red (positive) dramatically outperforming the black (negative) for the patient investor.

Best wishes

Mike