The Financial Pyramid: Four Steps to Figuring out Your Financial Needs

Achieving financial freedom and leaving a financial legacy depends on how you manage your money today. The Financial Pyramid provides a tangible tool to mapping this journey.

Finding financial freedom is the Holy Grail for many of us. We want to be able to live the good life while also leaving a financial legacy for our descendants.

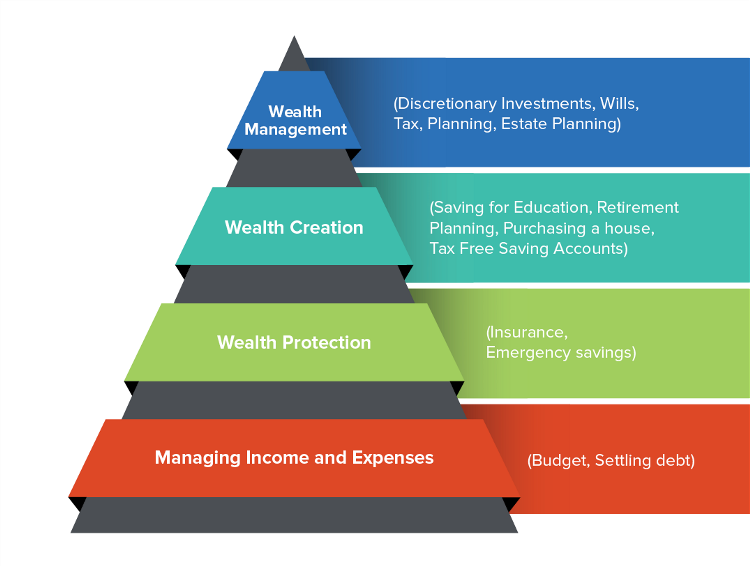

The question is: how do we accomplish this? A useful tool to work with is the financial pyramid. It’s a visual aid to help you understand the essential steps you need to take to reach your financial freedom. It’s like a map for your financial journey guiding you to your destination and forms a strong foundation for your overall financial plan so that you can meet your objectives even in the face of life’s uncertainties.

Let’s look at the four levels of the pyramid starting from the bottom.

1. Managing income and expenses

Before you can even start thinking about saving or investing, you need to make sure you have a workable budget. It must allow you to take care of your day to day needs and expenses such as accommodation and food, to service your debts (if you’re heavily indebted it’s best to start off by settling it as soon as possible) and hopefully still have a bit left over that you can put away to savings.

2. Wealth Protection (Risk Management)

Are you financially prepared if your assets are damaged or if the unthinkable happens and you lose your income-earning ability? People often skip or ignore this step in their financial plan, but without proper protection your entire financial plan is at risk.

The most common risks can be classified into two main categories: short-term risk and long-term risk.

Are you adequately protected against the financial loss of your assets? For example, what if your household effects are stolen or your house burns down? Protecting your assets requires short-term insurance. Examples include motor vehicle or homeowner’s insurance.

Protection in the event of death, disability or severe illness

In the event of accidental death or disability, your family is going to need an income either to replace the loss of yours and/or to cover medical expenses. That’s why you should have life and disability cover as well as income protection. Critical illness cover is also recommended.

3. Wealth Creation

This is the stage that most individuals want to start on; they tend to focus on how to create wealth before anything else. But only once you’re got a budget together and have the right asset and income protection in place, should you start investing. Whether you’re putting money away into a retirement fund, saving up for a child’s education or purchasing a home, it helps to have clear objectives and to choose a suitable investment based on the time frame of these objectives.

4. Wealth Management

Managing your wealth often means making use of a financial planner who can advise you on how to allocate your investments in a way that helps you realise your goals. They will continuously monitor and reconstruct the portfolio when there is a need to optimise returns considering your risk profile. Comprehensive financial planning incorporating your estate, investments, retirement and tax planning is important at this stage to ensure efficiencies in your financial plan.

The importance of a plan

Different individuals may start at different levels or see value in certain stages over others. However, following the financial pyramid is one of the ways to ensure that you have a concrete financial plan that will be able to withstand short periods of financial adversity without risking long-term goals.

Your financial future is in your hands. We ensure you don’t have to carry it alone. Let an NFB Private Wealth Manager build a personal financial strategy to guide your success.

#KnowledgeIntoWealth