Underperforming Markets and Shrinking Investment Returns

Mike Estment addresses the anxiety that investors experience when markets underperform.

The old adage of “stay the chase” comes to mind. As advisors, our role clearly includes making recommendations which match an investment need, having established each individual’s needs and unique circumstances. Importantly however, this is followed with what I like to term, “the motor plan”. Like when we buy a car and worry about it breaking down, needing a service and the like, making a financial investment is just step 1. For a car, a motor plan is a modern form of insurance. Although this probably comes at a premium given complexity, technology and purely cost considered, it makes sense to enjoy the peace of mind offered by the fact that if something happens, you simply reach out and the problem is solved.

In financial markets, having an advisor who is probably less emotionally invested to act as a sounding board when confronted with an event, a poorly performing investment, even a Black Swan such as Covid-19, becomes crucial. One of the most regular issues confronting advisors is the fear expressed by investors when markets go pear shaped. This is a time where the advisor and advisory business really earn their stripes. Over the last few years, our management team and IFAs have discussed the poor relative returns of local growth assets both internally and with clients. Whilst historically accurate and appropriate, the adage of “stay the chase”, has tested our clients’ patience and steadfastness, as well as ours.

The extraordinary circumstance in South Africa, given the grand theft of state resources, corporate mischief such as with Steinhoff, levels of state capture and the concomitant failure of these SOEs, the ratings agencies’ response by continued downward review of the creditworthiness, have all resulted in almost all aspects of investment underperforming their long-term benchmarks. This has also lasted way longer than is typical.

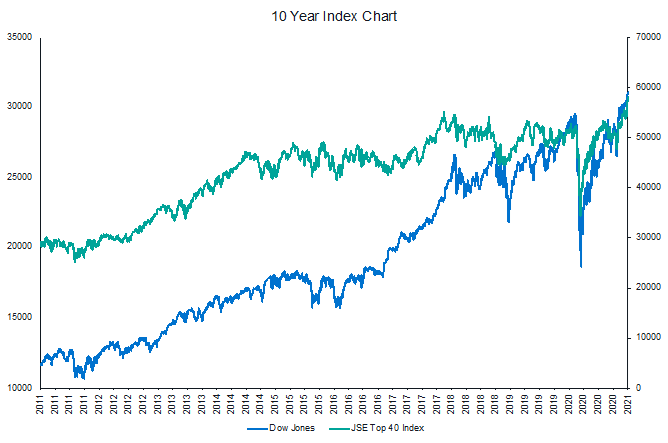

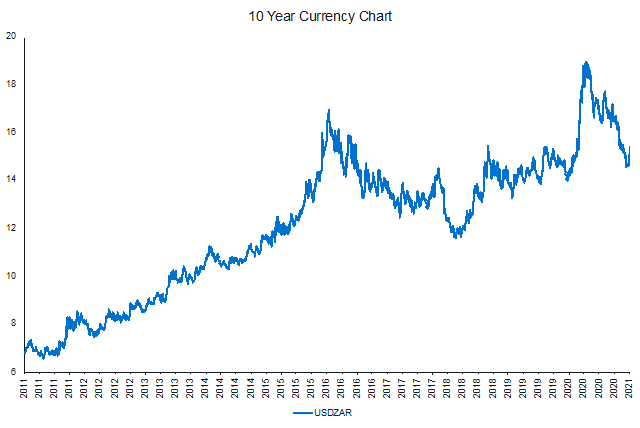

Staying the chase hasn’t been for the faint hearted, and cash (pre-tax), has in most instances been more rewarding in this period. However, this can and does change very quickly. This can be caused by factors both domestic or global, given the efficiency of information and the speed with which capital can flow. I have had our team put together some graphs showing the volatility and trajectory of reward of some common assets we regard as important to performance.

Clearly, our choice of investments, risk tolerance and other variables need careful consideration, but it is pretty clear that whilst cautious or cash type investments don’t suffer the same risk and volatility, the long-term advantage of exposure to growth assets remains established.

I continue to beat the diversification drum. This holds for asset classes, currency and term of deposits. I also repeat ad nauseam that if something looks too good to be true, it probably is! We are in a time and place where silly mistakes are made by investors in urgent need of returns.

An example of a confusing newish alternative are Crypto currencies such as Bitcoin. Crypto currencies are becoming mainstream. I don’t yet own any and have apparently missed out in another rather extraordinary run. But I do own cash, bonds, property, equity and structured solutions here and abroad. The institutions responsible for these are solid. However, they don’t all, always get it right. I also admit that every time I buy foreign currency for an overseas trip, it turns out to be a week to early, or late! In reality however, these imperfections pale into irrelevance in the big picture, although in the moment they irk my ego.

The point of this editorial is to encourage your engagement with our advisors and management. We remain committed to providing up to date, steady as she goes, and relevant advice. We don’t claim to be able to forecast currencies, markets or rates, but do offer a very experienced, objective and qualified team which uses experience and time on the block to help you achieve the appropriate allocation of cash to different solutions taking needs, risk and return as well as tax issues into account.

As we swiftly approach the beginning of February 2021, I would like, on behalf of all at NFB, to wish you a happy, healthy and safe 2021. We appreciate your support and use of NFB and the other divisions in our Group