Settling debt versus investing: What are my options?

Should I focus solely on settling my home loan or settling my home loan while simultaneously contributing to another investment?

I recently settled all of my debt (except for my home loan), and I'm currently in the process of saving up an emergency fund worth six months of my expenses. However, I am unsure what the best step is after funding the emergency fund.

I have R17,000 per month to either invest or use as an additional payment on my home loan (I still owe R850,000). If I put the whole amount toward my home loan every month, I should be able to pay off the house in about 3.2 years and then put the bond payment plus the R17,000 towards investing.

My other strategy is to use R3,000 per month to deposit into a TFSA and use the remaining R14,000 as an extra home loan repayment.

Would either of these be a good strategy, or should I consider a more effective approach?

I am 30 years old and do not have any other investments at this time.

Please note that the information provided below does not constitute financial advice; in fact, we are precluded from giving specific advice. Generic information has been provided given the context of your question. We have limited details about you and your circumstances, and such detail may impact any advice provided.

Congratulations on settling the majority of your debt. That is no easy accomplishment, especially for someone at your age. Your question regarding settling all your debt versus investing in the market is one that is often discussed, and there is more to it than meets the surface.

Before we discuss the various options which are available, it is important to understand the opportunity costs that you may forgo when transferring all available resources into your bond.

Pros

- Paying more than your bond repayment reduces the interest charged by the bank.

- Take advantage of the low-interest rate environment.

- By settling your bond at an earlier date, you can then allocate funds towards other investments sooner.

- If you have an access bond, this may provide liquidity or act as an emergency fund.

Cons

- Holding just property means you have an unbalanced asset class exposure in your portfolio.

- The age-old saying of "time in the market versus timing the market".

- Tax benefits of investing in specific investment products.

- Lack of liquidity if you do not have an access bond.

What we need to determine is whether you can achieve a greater return by investing in growth funds versus the rate of interest charged on your debt.

You have mentioned that you have additional funds over and above what you are currently paying into your bond. To break down the answer, there are a few assumptions we need to make.

- Age: 30

- Gross Salary: R60,000 p/m plus

- Marginal Tax Rate: 39%

- Interest Rate on loan: 7% per annum

- Return profiles:

- Retirement Annuity – 9% (Blend of managed and balanced funds)

- Tax-free savings – 10% (Medium- to high-equity funds)

- Unit Trust – 11% (Global exposure using offshore feeder funds)

Based on the above assumptions, you are currently paying R7,771 per month to pay off your bond over the selected term, with an additional R17,000 per month still to be allocated.

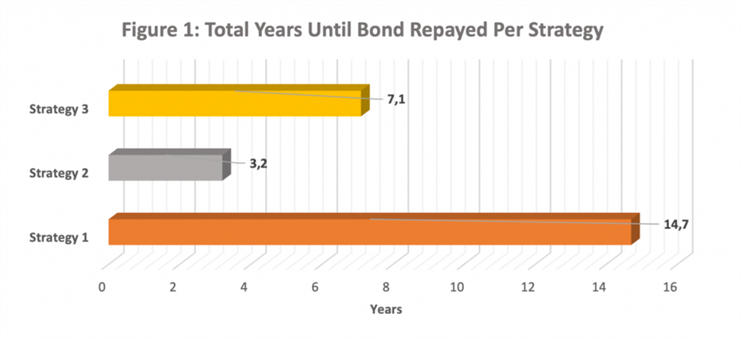

We will analyse three potential strategies available to you, using the assumptions mentioned above:

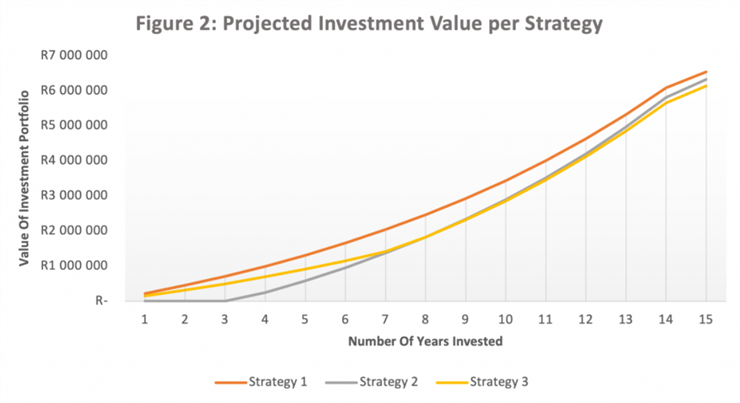

STRATEGY 1: Continue paying the minimum contribution into your bond and simultaneously invest R9,000 into a retirement annuity, R3,000 into a tax-free savings account, and R5,000 into a unit trust investment

STRATEGY 2: Use the additional R17,000 and your current bond instalment to settle the outstanding bond amount as soon as possible, and thereafter investing R9,000 into a retirement annuity, R3,000 into a tax-free savings account, and R12,771 into a unit trust investment.

STRATEGY 3: This is a hybrid approach, where you can contribute an additional R5,000 into your bond, while investing the remaining R12,000 into a retirement annuity (R9,000 per month) and tax-free savings account (R3,000 per month). Once the bond has been settled, you can then allocate that repayment towards a unit trust investment.

Figure 2 illustrates the projected value of investing into a retirement annuity, tax free savings account and a unit trust per each strategy over the 14.7 years it would take you to pay off your bond only contributing the minimum amount.

Therefore, based on the assumptions made, your investment portfolio would be better off using strategy 1, where you continue paying the minimum contribution into your bond and simultaneously invest R9,000 into a retirement annuity, R3,000 into a tax-free savings account, and R5,000 into a unit trust investment. This strategy emphasises being invested with a long-term outlook and a blend of different funds.

There are a variety of advantages of investing in different investment products and not just limiting your selection to just one. Within a retirement annuity your contributions are tax deductible to a maximum of 27.5%, this means that you can pay less tax and returns on your investment are tax free. While investing in a unit trust may not have the same tax advantages as a retirement annuity, there are no restrictions on how much you can invest in specific asset classes.

It is important to note that your age provides you with the opportunity to hold an overweight position in an asset class where the risk-return profile is higher (for example, an overweight position in global equities). The reality is that asset allocations drive returns in a well-diversified portfolio, and by having the majority of your portfolio allocated only to property, you risk losing out on investing in the market.

The reality is that asset allocations drive returns in a well-diversified portfolio, and by having the majority of your portfolio allocated only to property, you risk losing out on investing in the market.

One disadvantage of using strategy 1 is the length of time it would take to pay off your bond when compared with strategy two and three, as illustrated in Figure 1. When it comes to paying off debt, the situation is different for everybody.

We therefore need to analyse each scenario on a case-by-case basis. For example, the strategy for a young individual with the time and means to pay off a bond over its term and simultaneously save for retirement versus that of an individual nearing retirement who needs to get debt free as soon as possible will have very different approaches to their debt. The role of the financial adviser is to gather the relevant information and guide the individual on the best path for them.

As a young investor, building a well-structured investment portfolio that provides diversification across different asset classes and having a pre-retirement plan that is in line with your financial goals is an achievement well worth pursuing.

|

This reader question, "Settling debt versus investing: What are my options?" was published on Moneyweb. |