2023 Budget Speech Overview

How does this year’s budget affect you?

Fiscal restraint was the order of the day as Finance minister Enoch Godongwana delivered his second annual budget speech on the 22nd February 2023 amidst a current economic climate that can only be described as tough. The focus was on how the government planned to stimulate sustainable growth in an economy reeling from rolling blackouts, inflation, high unemployment, and inequality.

As always, taxes, debt service costs, and the precarious position of state-owned enterprises were key on the agenda. The reminder, too, that only through sustained economic growth, driven primarily through infrastructure investment, can South Africa expect to see a decrease in poverty and increase in employment had a bold mention. One positive to take was the announcement of another tax collection windfall for the year – this time R93.7 billion over the 2022 budget. This windfall has come at a good time for SA, but Godongwana was quick to stress the need for fiscal responsibility herein as South Africa still sits in a precarious fiscal position and spending needs to be controlled and focused.

Budget overview

Government will achieve a main budget primary surplus in 2022/2023. The consolidated budget deficit will decline from 4.6 percent of GDP in 2021/22 to 4.2 percent of GDP in 2022/2023, reaching 3.2 percent of GDP in 2025/2026.

On top of everyone’s budget wish list was no material increases in tax. South Africans can breathe a collective sigh of relief here as value-added tax, taxes applicable to trusts, donations and death have not increased. Furthermore, the brackets of the transfer duty tables increased by 10 percent, meaning properties purchased below R1.1 million will avoid transfer duty completely.

The government has provided a R4 billion tax relief scheme for individuals that install solar panels and R5 billion to companies through an expansion of the renewable energy tax incentive. Individuals will be able to claim a rebate to the value of 25 percent of the cost of new and unused solar photovoltaic (PV) panels, up to a maximum of R15 000 per individual. This incentive will be available for one year.

Furthermore, businesses will be able to reduce their taxable income by 125 percent of the cost of an investment in renewables in the first year of operation with effect 1 March 2023 to 28 February 2025. There will be no thresholds on the size of the projects that qualify, and the incentive will be available for two years to stimulate investment in the short term.

Changes to retirement savings

Retirement tax tables for lumpsum before retirement and at retirement will be adjusted by 10 percent. The adjusted tax table are below with effect 1 March 2023.

Retirement fund lumpsum withdrawal benefits:

| Taxable Income | 2023/24 Rate of Tax |

|---|---|

| R1 – R27 500 | 0% of taxable income |

| R27 501 – R726 000 | 18% of taxable income above R27 500 |

| R726 001 – R1 089 000 | R125 730 + 27% of taxable income above R726 000 |

| R1 089 001 and above | R223 740 + 36% of taxable income above R1 089 000 |

Retirement fund lumpsum benefits or severance benefits:

| Taxable Income | 2023/24 Rate of Tax |

|---|---|

| R1 – R550 000 | 0% of taxable income |

| R550 001 – R770 000 | 18% of taxable income above R550 000 |

| R770 001 – R1 155 000 | R39 600 + 27% of taxable income above R770 000 |

| R1 155 001 and above | R143 550 + 36% of taxable income above R1 155 000 |

Government intends to publish revised draft legislation on the ‘two-pot’ retirement system. This will include details on the ‘liquid portion’ that could be immediately available when the system is implemented from 1 March 2024. Any withdrawals from the accessible “savings pot” would be taxed as income in the year of withdrawal.

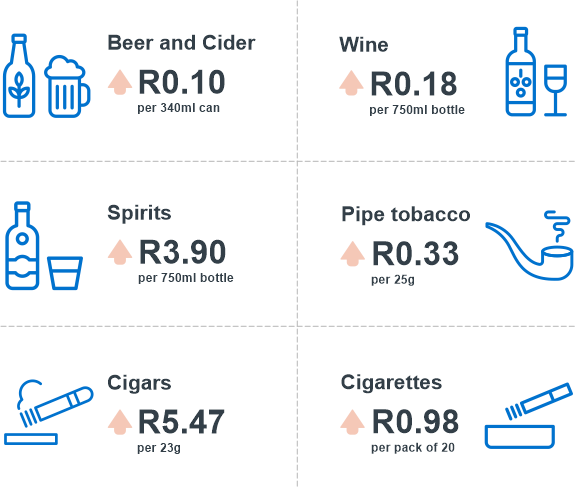

Overall, despite the increases in taxes on alcohol and tobacco products by 4.9 percent, we are of the opinion that these tax adjustments show that government understands some of the pressure that the average South African has been under given general inflationary conditions in our country. There seems to be acknowledgement that South Africa has reached the point of diminishing returns when it comes to tax rates. In our view, the general public should be satisfied with this part of the budget.

Sin Taxes

Energy and Electricity

With record loadshedding, commentary on Eskom was always going to be highly scrutinised. The government proposed a total debt-relief arrangement for Eskom of R 254 billion. This consists of two components. One is R184 billion. This represents Eskom’s full debt settlement requirement in three tranches over the medium term. Second is a direct take-over of up to R70 billion of Eskom’s loan portfolio in 2025/26. Because of the structure of the debt relief, Eskom will not need further borrowing during the relief period. Government will finance the arrangement through the R66 billion baseline provision announced in the 2019 Budget, and R118 billion in additional borrowings over the next three years. However, as expected this debt-relief program will be accompanied by strict criteria. These criteria includes things like Eskom focussing on maintenance in current fleet as well as prioritising capital expenditure in transmission and distribution during the debt-relief period. Furthermore, the debt relief is to be used solely for debt and interest payments and there will be strict control measures in place in order to ensure this is adhered.

Debt position

Servicing debt requires an increasing share of government’s available resources. Debt-service costs have been a problem that Treasury has failed to adequately control over the last few years and is expected to average R366.8 billion a year over the medium term. This is a massive issue as these debt-service costs drain valuable resources that could be used for important social issues such as healthcare, education and infrastructure development.

Spending programmes to enhance growth

Total consolidated government spending will amount to R7.08 trillion over the next three years, of which 51 per cent or R3.6 trillion is allocated for the social wage.

- The 2023 Budget allocates additional funding totalling R227 billion over the next three years. The additional funds are mainly to extend the COVID-19 social relief of distress grant until 31 March 2024, improve investment in local and provincial government infrastructure, and support safety and security, education and health services.

- The learning and culture function is allocated R1.43 trillion over the next three years – the largest proportion (24 per cent) of total allocated spending.

- Community development is the fastest growing function, averaging 8 per cent annually over the medium term, mainly due to the allocation of additional funds for the local government equitable share and for infrastructure.

Conclusion

Overall, the budget speech had both positives and negatives. This budget speech was always going to be challenging due to the tight-rope nature of South Africa’s current fiscal position. On the positive side, no increases in the fuel levy or RAF (in fairness though, a huge component of the price of fuel goes to government coffers already) as well as adjustments to certain tax brackets and potential tax rebates for solar installation will be welcomed by SA consumers. Furthermore, Treasury is sticking to its tough stance on the public sector wage bill, accommodating a 3.30% increase annually over the next three years – below Treasury’s average consumer price inflation forecast. On the negative side, the most obvious issue is the comments and money being made available to failed state owned entities. This speaks to an ideological issue within government. Although these ‘bailouts’ have strict conditions to them – SA citizens have to be wondering how much longer they will be bailing out these institutions for? These funds could be used for social betterment within SA such as health care, crime prevention or education.

Pessimists will note that much of the budget is based on the assumption that government can and will hold the line on expenditure, despite evidence that it has bowed to political pressure and capitulated on these issues in the past. In the end, it is action, not words, that will strengthen our economic outlook.

Key budget documents

Watch the Budget Speech Live Stream

Download the complete 2023 Budget Speech (1,697kb)

Full Budget Review (13mb)

Tax Guide (529kb)